Deposit takers course

Our free deposit takers course has been designed for bank, building society and credit union staff.

Completing the course will enable you to confidently advise your customers, by gaining a greater understanding of the protection we can provide.

Key topics covered

- What FSCS is and why it's important.

- The protection FSCS provides to your customers.

- Levels of compensation and the claims process.

- Why you must prominently display FSCS information.

There's also an eLearning version that will play on your PC/laptop. If you're unsure how to install the download, ask your IT team.

Deposit protection Q&As - banks and building societies

- The bank or building society must be authorised by the Prudential Regulation Authority (PRA).

- In certain cases, the account holder(s) determines the protection limit that applies and how that applies. For example, the way a trust is set up means different limits might apply.

- Protection is across all accounts held within the bank/banking group, not per account.

- The customer does not have to live in the UK for FSCS protection to apply but the bank or building society must be UK authorised.

- If a bank or building society fails, FSCS will automatically pay back customers’ money within seven working days in most cases. FSCS always aims to get customers their money back as soon as possible.

- Reimbursements for temporary high-balance claims and accounts where the beneficial owner of the funds is not obvious (for example, where monies are held under trust arrangements) can take up to three months.

What is the Financial Services Compensation Scheme (FSCS)?

FSCS can pay compensation to customers of authorised financial services firms when they fail. Set up by parliament and funded by the financial services industry, FSCS is a completely independent and free service. This means FSCS can pay back any money you hold with a failed bank or building society, up to its compensation limit of £85,000 per person.

I'm am individual account holder. Am I protected?

Yes. FSCS protects up to £85,000 in total across all accounts you hold, either in your name or where you are listed as the beneficial owner (e.g., money held on your behalf in a client account) within the bank/banking group.

We are joint account holders. Are we protected?

Yes. FSCS protects each of you (any number of account holders) up to £85,000 in total across all accounts you hold, in your name or where you are listed as the beneficial owner (e.g., money held on your behalf in a client account) within the bank/banking group.

I have a company, but I am a sole trader. How is my money protected?

FSCS protects you up to £85,000 in total across all accounts you hold within the bank/banking group. If you’re a sole trader, your company is not treated as a separate entity. That means FSCS can protect up to £85,000 in total across all personal and business accounts you hold with the bank.

I have a company that is a partnership/limited company. How is my money protected?

If your business is a separate legal entity, e.g., a limited company or LLP, it is protected up to £85,000. This is in addition to the £85,000 protection across all individual accounts you hold within the bank/banking group. In this situation, the business is the protected entity, not each individual.

Most businesses are protected, but authorised financial services firms are not. See a full list of who isn’t protected in the Prudential Regulation Authority’s Rulebook.

There is no size test.

We are joint account holders of a business account. Are we protected?

Yes. FSCS protects you up to £85,000 in total across all accounts you hold in your business name, within the bank/banking group. This is in addition to the £85,000 protection across all individual accounts you hold within the bank/banking group. In this situation, the business is the protected entity, not each individual.

Most businesses are protected but authorised financial services firms are not. See a full list of who isn’t protected in the Prudential Regulation Authority’s Rulebook.

There is no size test.

I have several business each with their own account in the same bank/banking group. Are they protected?

If each business is a separate legal entity, FSCS would protect each one up to £85,000 in total across all accounts held within the bank/banking group.

If your businesses are branches of the same legal entity, FSCS has to treat them as one business so protection is for only one amount of £85,000 in total across all accounts within the same bank/banking group.

Authorised financial services firms are not covered. See a full list of who isn’t protected in the Prudential Regulation Authority’s Rulebook.

There is no size test.

How does FSCS protect my child's account?

If the account is an individual account held in the child’s name, FSCS protects up to £85,000 in total across all accounts they hold, either in their name or where they are listed as the beneficial owner (e.g., money held on their behalf in a client account) within the bank/banking group.

If the money is held in a child trust fund or junior ISA account, the compensation will have to be paid into another ISA, rather than being cashed.

We are an unincorporated association. Are we protected?

Yes. FSCS protects you up to £85,000 in total across all accounts you hold in your association’s name within the bank/banking group.

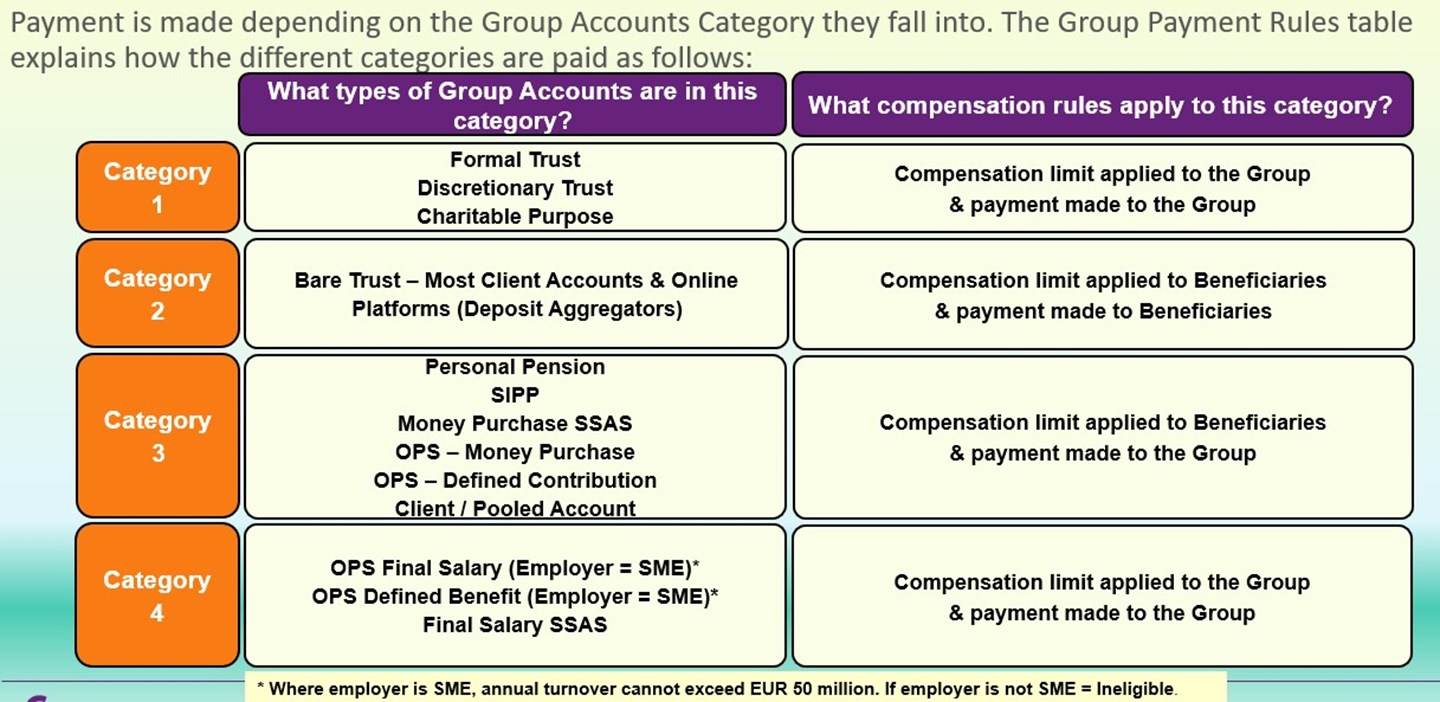

Group accounts

I have an account in my own name, and I'm also the beneficiary of a group account listed in the question above where the account is help within the same bank/building society. Am I protected?

Yes. FSCS protects you up to £85,000 in total. This is because, although the trust/pension/client account may not be in your name, the part of the account that you are entitled to belongs to you as an individual. Our rules state that we can only pay an individual £85,000 in total across all accounts held in their name within the bank/banking group.

FSCS would also protect other beneficiaries of the trust/pension/client account up to £85,000 in total.

The account is held for a formal trust/discretionary trust/charitable purpose/OPS - final salary/OPS - defined benefit/final salary SSAS. Is it protected?

Yes. FSCS protects eligible beneficiaries up to £85,000 in total across all accounts held in the bank/banking group. In this situation the type is the protected entity; therefore, the maximum protection per type is £85,000.

The funds are held in an account that is held for a bare trust, personal pension, SIPP, money purchase SSAS/money purchase or defined contribution OPS/client/pooled account. Is it protected?

Yes. FSCS protects eligible beneficiaries up to £85,000 for each beneficiary of the type across all accounts held in the bank/banking group. If any of the beneficiaries have their own account within the same bank/banking group, that may affect the amount they are eligible for, as they are only protected up to £85,000 in total.

The account is held for a charity. Is it protected?

The way the charity is set up determines FSCS protection. This will be either as a company or a trust (for each of these situations, responses are provided above).

What protection is there for wealth management companies or other online platforms that allow customers to spread funds across different banks?

If the wealth management company is authorised and regulated (which it is likely to be) its own funds wouldn't be covered for deposit protection.

However, if the customer holds deposits in a bank via the wealth management company or online platform, their eligibility for deposit protection would be dependent on how the funds are held with the bank.

FSCS wouldn’t be able to confirm eligibility of specific deposits until the point of the firm failing. However, if the funds held via the wealth management company or online platform have been set up under a ’bare trust’ arrangement, we may be able to look through the named account holder to regard each eligible underlying beneficiary as having a separate claim for up to £85,000.

If the customer’s funds are held via the wealth management company or online platform under a non-bare trust arrangement, a maximum of £85,000 only applies irrespective of the number of eligible beneficiaries or separate accounts held.

See our compensation limits for banks and building societies

FSCS deposit protection - credit unions

What is the Financial Services Compensation Scheme (FSCS)?

FSCS can pay compensation to customers of authorised financial services firms when they fail. Set up by parliament and funded by the financial services industry, FSCS is a completely independent and free service. This means FSCS can pay back any money you hold with a failed credit union, up to its compensation limit of £85,000 per person.

What do I need to do to get my money back if my credit union fails?

You don’t need to do anything. FSCS will automatically pay back your money using the account information it receives from your credit union.

How soon will I get my money back if my credit union fails?

In most cases, FSCS will return your money within seven working days from the date your credit union failed.

How will FSCS pay back my money if my credit union fails?

FSCS will send you a cheque payment in the post within seven working days of a credit union being declared in default. In some cases we may be able to make your payment through cash over the counter at the Post Office. If that's the case we'll send you a letter (in an unmarked envelope for security reasons) to get cash over the counter at the Post Office. You do not need to fill out an application form to receive your compensation payment if your credit union has failed, this is an automatic process. If your deposit is protected under our temporary high balance criteria, you'll need to contact us to request an application form.

I'm an individual account holder. Am I protected?

Yes. FSCS protects up to £85,000 in total across all accounts you hold with the credit union.

We're joint account holders. Are we protected?

Yes. FSCS protects each of you (any number of account holders) up to £85,000 in total across all accounts you hold with the credit union.

I've got a small business account and a personal account with the credit union. Are both accounts covered up to £85,000

If your business is a separate legal entity, e.g., a limited company or LLP, you could claim up to £85,000 for the company and up to £85,000 for your personal account. If you’re a sole trader (e.g., Mr Smith t/a Smith Motors) you wouldn’t be entitled to two separate claims – you could claim up to £85,000 in total. As an exception, business partnerships can make two separate claims (but only one claim, not one claim per partner).

Most businesses are protected but authorised financial services firms are not. See a full list of who isn’t protected in the Prudential Regulation Authority’s Rulebook.

There is no size test.

I have several business each with their own account at the credit union. Are they protected?

If each business is a separate legal entity, then FSCS would protect each one up to £85,000.

Branches of the same legal entity are considered to be the same business, so FSCS can protect up to £85,000 in total across all these accounts within the same credit union.

Most businesses are protected but authorised financial services firms are not. See a full list of who isn’t protected in the Prudential Regulation Authority’s Rulebook.

There is no size test.

How does FSCS protect my child's account?

If the account is an individual account held in the child’s name, FSCS protects up to £85,000 in total across all accounts they hold, either in their name or where they are listed as the beneficial owner (e.g., money held on their behalf under a trust arrangement).

If the money is held in a child trust fund or junior ISA account, the compensation will have to be paid into another ISA rather than being cashed.

Subscribe to course updates

By entering your email address above, you’re allowing us to email you about updates to the course. To do this, we need to hold and process your data. For more information, please view FSCS’s data protection statement and our privacy policy.