FSCS and the Financial Ombudsman Service

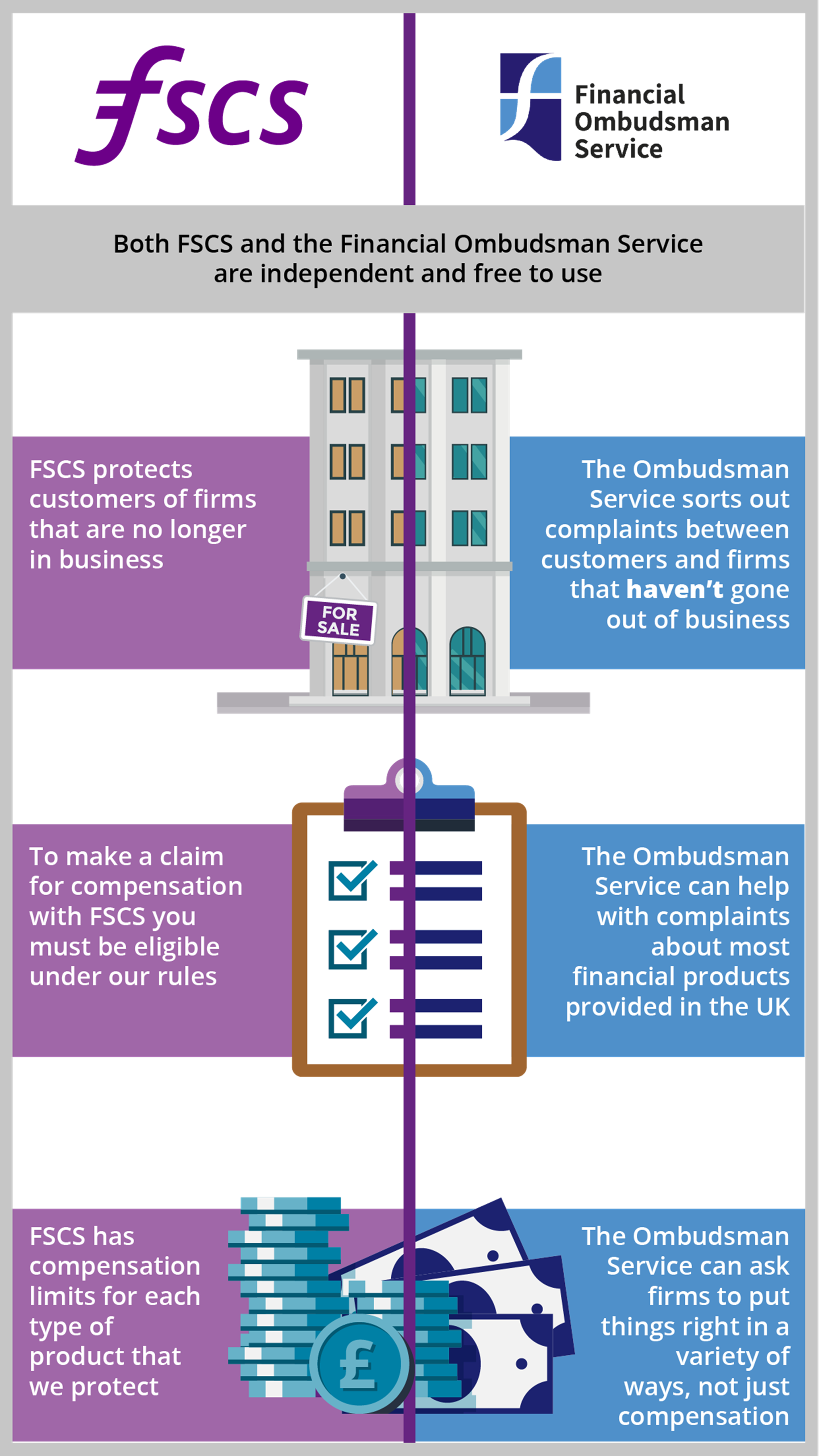

If something’s gone wrong or you have a complaint against a regulated financial services firm, you may not know where to go for help. FSCS and the Financial Ombudsman Service both get people back on track and are independent and free to use, but each has different roles and rules.

To help you find your way to the right place, we’ve summarised the main differences between FSCS and the Financial Ombudsman Service.

Here's more detail:

| FSCS | The Financial Ombudsman Service |

| FSCS protects customers of financial services firms that have gone out of business. If the firm you’ve been dealing with has failed and can’t pay back your money, come to FSCS to see if you’re eligible to claim compensation with us. It’s completely free to claim with us. | The Financial Ombudsman Service can help if you’ve got a complaint against a financial firm that hasn’t gone out of business. If you and the firm can’t resolve a complaint yourselves, the Financial Ombudsman Service will put things right if it decides you have lost out or been treated unfairly. The Financial Ombudsman Service is also free to use. |

| FSCS protects regulated financial products and services, including bank and building society accounts, mortgages, insurance, pensions and investments. To claim compensation with FSCS you must be eligible under our rules. | The Financial Ombudsman Service can help with complaints about most financial products and services provided in or from the UK, including debt collection, payday loans, insurance, mortgages and problems with claims management companies. When you get in touch, the Financial Ombudsman Service will let you know if the complaint is something it can help with. |

| The amount of compensation FSCS can pay depends on the type of financial product or service your claim relates to. Find out more about our compensation limits. | The Financial Ombudsman Service can tell the firm to compensate you for the loss it caused. There are several things it can tell a firm to do to put things right, including paying you money for financial loss, putting things right in a way that doesn’t involve paying money, or paying you money to recognise the impact of what went wrong. Find out more about Financial Ombudsman Service compensation. |