The role of the retail pool

Following the article about How we forecast the levy, we promised an explainer on the retail pool. Our Chief Financial Officer, Fiona Kidy, reveals all about how the class contributions work, what the retail pool is and when we need to use it.

We offer our customers a completely free service thanks to an annual levy paid by authorised financial services firms. This levy funds the cost of the compensation we pay our customers, as well as the costs of running our service and processing claims.

The annual levy has many moving parts (see our article on How we forecast the levy for more background information), one of which is the retail pool levy. We are keen to shine a light on the retail pool to further educate stakeholders on how the current arrangements work.

The retail pool, a cross-subsidy if a funding class breaches its limits, has been used in two out of the last four financial years. In the 2020/21 financial year, a retail pool of £44m was called upon and in the 2018/19 financial year, the amount was £78m. Our forecast doesn’t currently expect to need the retail pool in 2022/23 or 2023/24. However, if there were big changes in certain funding classes, it could still be that we would need the retail pool in those years.

The retail pool has also been in the news recently, as the Financial Conduct Authority (FCA) published its feedback to its call for input on the Compensation Framework Review.

Funding classes

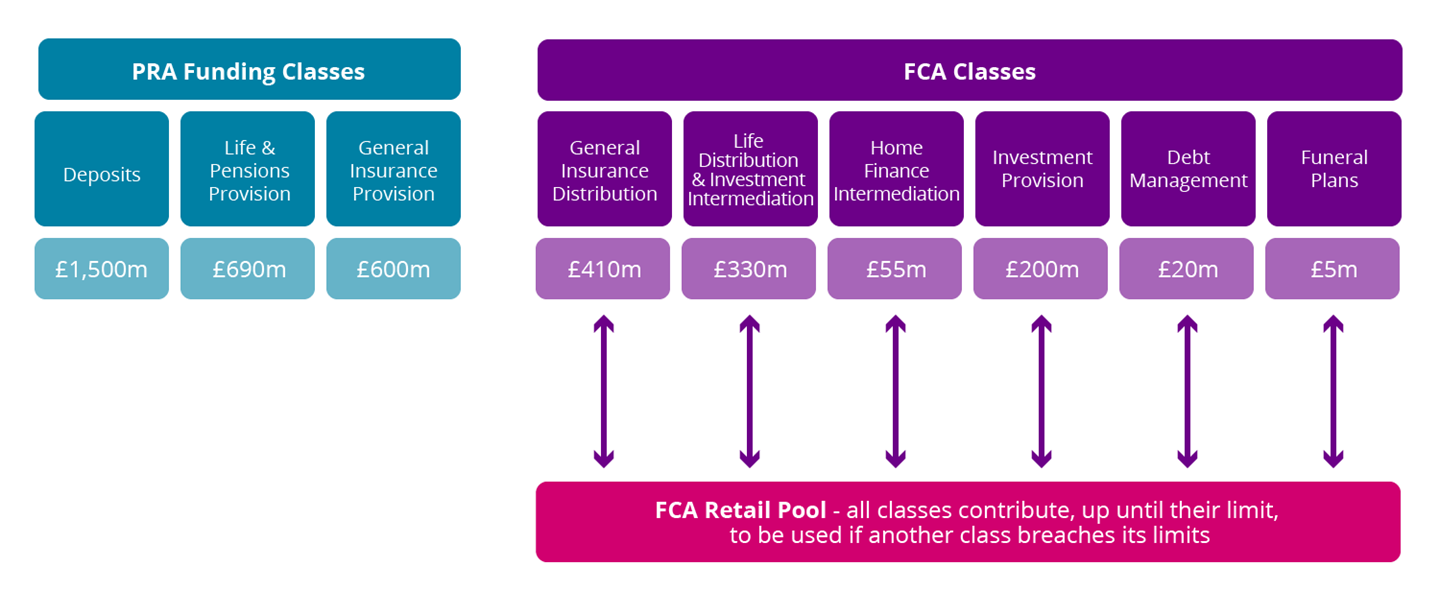

For funding compensation costs, the FSCS levy is split into funding classes (the 9 listed here and Deposit Acceptors - which is only called upon if the retail pool is triggered):

- Deposits

- Life and Pensions Provision

- General Insurance Provision

- General Insurance Distribution

- Life Distribution and Investment Intermediation

- Home Finance Intermediation

- Investment Provision

- Debt Management

- Funeral Plans

These classes are groupings of broadly similar firms, based on the products they provide, sell, distribute, or advise on.

The levy is calculated based on the cash that we expect to pay out in a year – we don’t aim to hold extra funds. However, the reality is that the amount we pay out can be different to the originally expected and levied amount for each year. This variance creates a surplus or deficit in our levy funds.

We constantly monitor our projected year-end surplus or deficit, and we look at it on a class-by-class basis. If the deficit for an individual class is significant (normally £20m or more) then we look to raise a supplementary levy on that class. We do this even when there are surpluses in other classes because those surpluses were paid for by other, unrelated firms. We keep each class separate because one class shouldn’t cover another class’s shortfall, apart from when the retail pool is triggered.

Industry discussions

There is though a growing debate within the financial services industry about alternative approaches to funding the compensation framework. This debate often relates to the use of the ‘retail pool’ – as it is a fund to which all firms contribute towards, it potentially means that firms cover compensation costs that arise from a different class, due to the threshold for that class being exceeded.

The retail pool

If the funding requirements of levies in a particular funding class exceed the levy limit for that class, the excess cost is covered by the other classes as part of the retail pool. This is a separate pot that other classes are required to contribute to, if they have not reached their own levy limit. It is only used when one FCA class exceeds its annual levy limit and requires additional funding. As mentioned, this has been used in two out of the last four financial years.

Most recently, in 2020/21, the retail pool was used for a total of £44m as the Life Distribution and Investment Intermediation class went over its class funding limit. The biggest contributor to the retail pool levy in that year was the General Insurance Distribution class, which paid £23m.

The retail pool approach

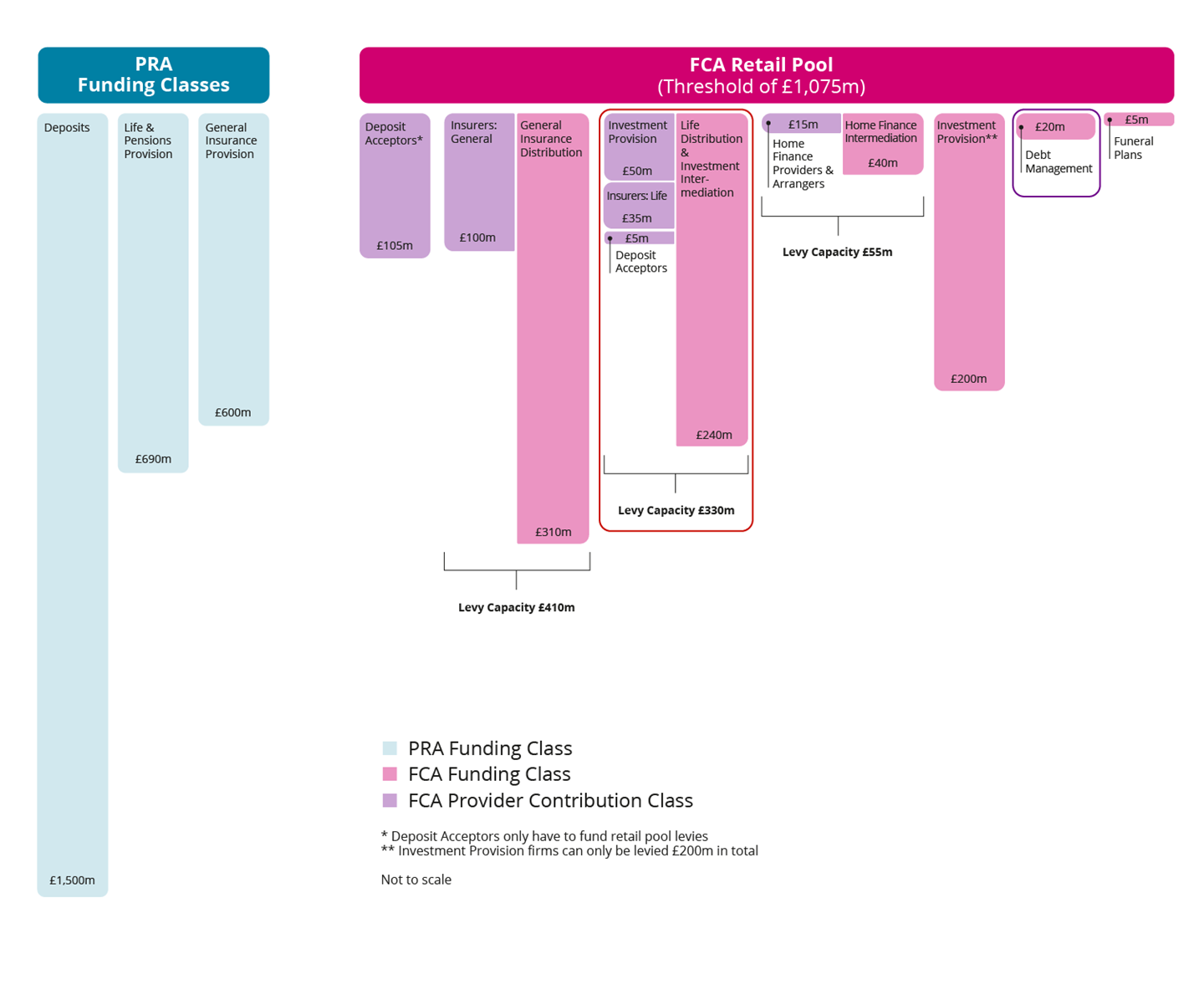

A cross-subsidy approach is used to fund the claims for a class that has exceeded its annual funding limit. The cross-subsidy is funded by the classes belonging to the retail pool. The amount of retail pool levy provided by each class depends on the class’s capacity and levy limit.

An individual firm’s retail pool levy for the funding classes is based on a firm’s annual eligible income data that they submitted at the start of the levy year. This is the same data that is used to calculate the FSCS compensation cost and specific cost levy as shown on a firm’s annual fee and levy invoice.

Retail pool examples

If we look at the Life Distribution & Investment Intermediation class, (highlighted by the red box above) levies of £330m can be raised, comprised of £240m of class contributions and £90m of provider contributions. However, if for example, £350m of funding was required for that class in a financial year, the retail pool would be called upon for the remaining £20m.

Retail pool contributions are not paid if a class has already reached its class limit. For example, in the Debt Management class (highlighted by the purple box above) if this class has already paid its £20m limit, then no retail pool contribution will be due.

Funeral plans

It is also worth noting that Funeral Plans became regulated from 29 July 2022. Newly authorised firms in this class do not pay any levies, including retail pool contributions, in their first year of regulation.

The future

We are open to constructive dialogue about the funding model and objective analysis about how it might best benefit consumers and industry. We have set out a number of considerations within The balancing act of compensation to inform this important topic.

We are, however, keen that the debate around the levy does not become overly dominated by a short-term focus. The ultimate goal should always be to ensure the UK’s compensation framework can continue to fulfil its role within the financial services ecosystem on an effective and sustainable basis, whilst also taking action to reduce the underlying consumer harm that is driving the increasing cost of compensation.

Further information

I hope this article has been useful. If there's another topic you'd like us to explain, we're always open to ideas. Drop us an email at communications@fscs.org.uk.