How FSCS supported customers of MCE Insurance

FSCS declared MCE Insurance Company Ltd in default on 19 November 2021. At that time it had close to 105,000 policyholders in the UK, creating a big job for FSCS's various teams.

What happened?

MCE Insurance Company Ltd, now known as Green Realisations 123 Ltd (in administration), was an insurance company based in Gibraltar. FSCS declared the firm in default on 19 November 2021 and at that time it had close to 105,000 policyholders in the UK. Most of these customers had motorbike or scooter insurance and there were also some car and van insurance customers. A lot of these customers used their vehicles for delivery or courier services.

When an insurance company fails, there are two potential outcomes regarding the policies that customers hold:

-

The policies will be replaced by a new insurer, so customers have uninterrupted cover

-

Customers may receive a refund based on the cost of their insurance premium

We also fund the payment of valid claims against policies.

We have more information about the process here. You may also be interested in our podcast on this topic.

The administrators of MCE Insurance Company Ltd made the decision to cancel all these policies in January 2022 meaning these policyholders had to buy new motor insurance to keep their vehicles on the road.

“I knew that if FSCS were dealing with it everything would get fixed at some point, but never expected it to be dealt with so smoothly and quickly.”

How did FSCS respond?

FSCS’s data team started working with MCE UK (the affiliated UK broker) and the Joint Administrators to gather and validate customer data.

It became clear that within the data, customers’ bank account details were not recorded, as customers had paid by card, which meant we’d need to make compensation payments to eligible customers by cheque. To do this, we needed to validate and verify customer addresses to ensure payments were sent as quickly as possible.

“The process worked for me, I was able to plan ahead based on the information from the start and what I expected to receive in terms of compensation was what I got, it was straightforward - well done.”

What new measures has FSCS introduced to support customers?

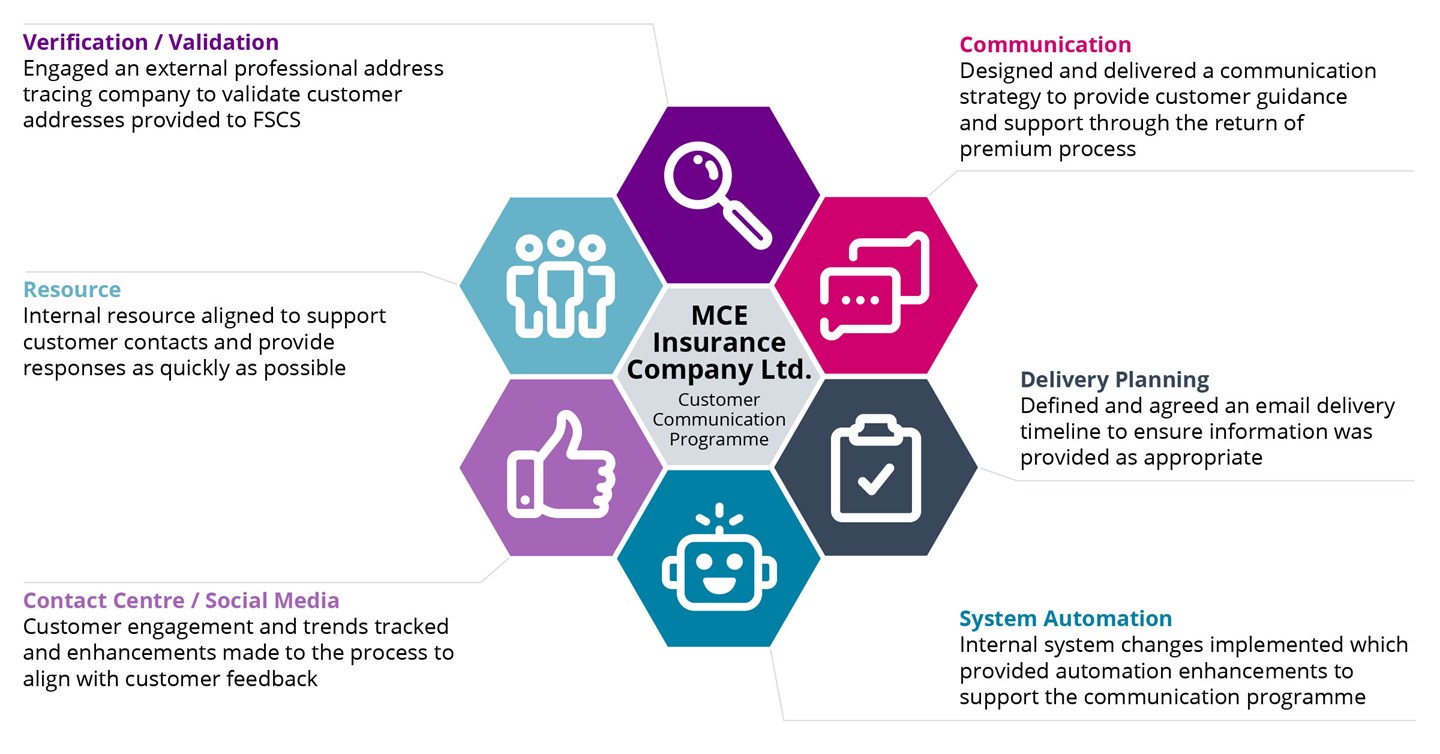

FSCS put in place a programme of proactive communications to guide and support customers through the different stages of the process, until they received their return of premium compensation payments.

This enabled us to keep each group of policyholders informed as the data came through to us in several different batches.

We sent out three key email letters to all customers:

- an introductory letter that explained the failure, FSCS’s involvement, and the process to come;

- a return of premium letter that explained that payment was on its way; and

- a follow-up letter to check customers had received their payment and that everything was as they expected.

We also set up a new customer payment approach to make payments as quickly as possible to customers where we had low confidence in their postal address due to gaps in the data we received.

“It was great to feel that FSCS had my back, and I didn't have to take action or worry, I just had to wait. I felt informed and looked after.”

What have been the results and successes?

As well as the regular communications we sent to customers, we published a series of Q&As and progress updates on our dedicated webpage.

Key measures on this project included:

- we sent out over 300,000 proactive customer communications;

- we traced and confirmed over 96,000 customer addresses;

- we paid back over £15.5m in return of premiums;

- we also paid over £20.1m in indemnity payments. This is where policyholders or third parties have made a claim against the policy cover, for example, for an accident or vehicle theft; and

- we introduced four improved customer processes that can now be replicated for other customers.

We continue to work through the last few hundred outstanding customers where we are still confirming address and ID documentation, to then process their return of premium compensation payments.

All this meant that over 90% of these customers had their payment sent out within three months of all policies being disclaimed at the end of January.